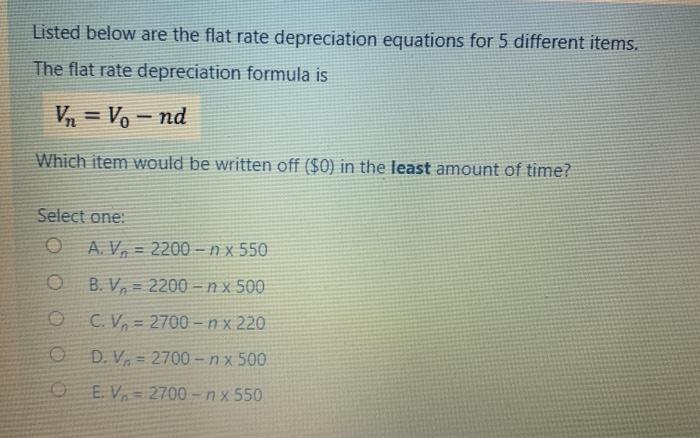

Flat rate depreciation formula

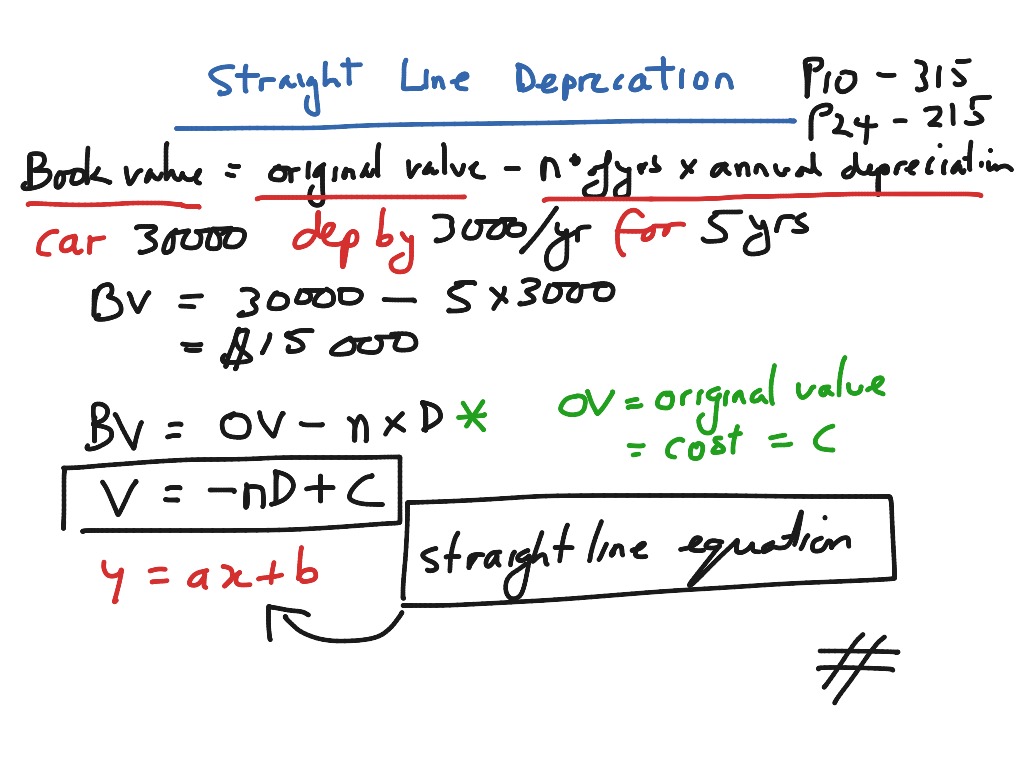

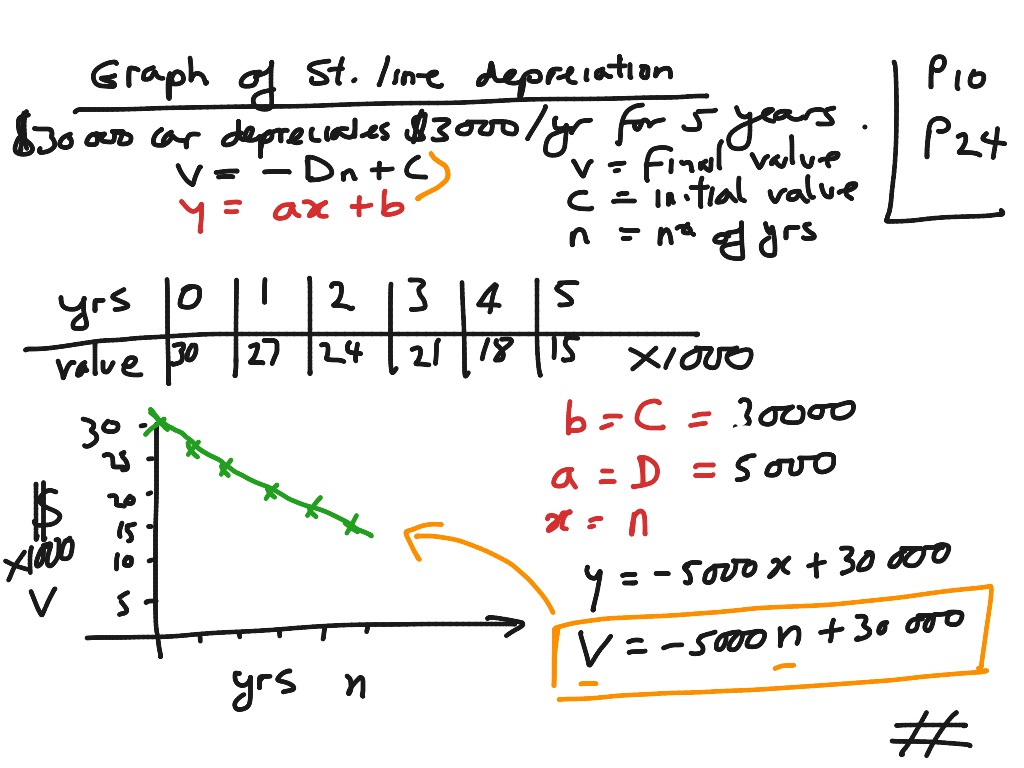

To make calculations in flat rate depreciation use the formula BV T P dT where. To make calculations in flat rate depreciation use.

2

FA_FLAT_RATES contains the annual depreciation rates the depreciation program uses to calculate depreciation for assets that use flat rate depreciation methods.

. Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the. Cost of machine 10000 Scrap value of machine 1000 Machines estimated useful life 5 years Annual Depreciation Cost of Asset Net Scrap ValueUseful Life. Oracle Assets uses a flat-rate and either the recoverable cost or.

The depreciation rate for a building is less as compared to other assets that depreciate. Read the latest contents about flat rate depreciation formula in Malaysia Check out Latest Car News Auto Launch Updates and Expert Views on Malaysia Car Industry at WapCar. Depreciation Calculation for Flat-Rate Methods.

The depreciated value of the property is 1060 ie. When these options are used PeopleSoft Asset Management uses three separate formulas to. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Here is the step by step approach for calculating Depreciation expense in the first method. For instance if a buyer is selling a property after 10. Depreciation rate varies across assets and is determined based on the nature and use of the asset.

School Royal Melbourne Institute of Technology. The formula to calculate Useful Life is. Depreciation method can be combined with either a monthly or yearly averaging option.

To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. Number of Periods in Year Year End - Begin Depr Date 6 12312006 - 7012006 Percentage Depreciation for Year Number of Periods in YearRemaining Life 10 6 60 Yearly. Cost Salvage Value Cost x Depr Rate For example an asset that is worth 1000 and a salvage value of 50 with a 475 annual.

Use a flat-rate method to depreciate the asset over time using a fixed rate. This is the cost of the fixed asset.

Annual Depreciation Of A New Car Find The Future Value Youtube

2

2

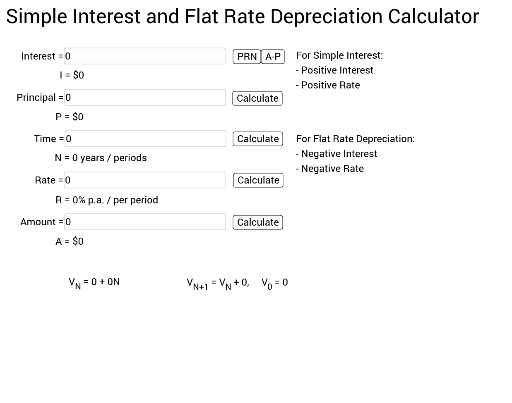

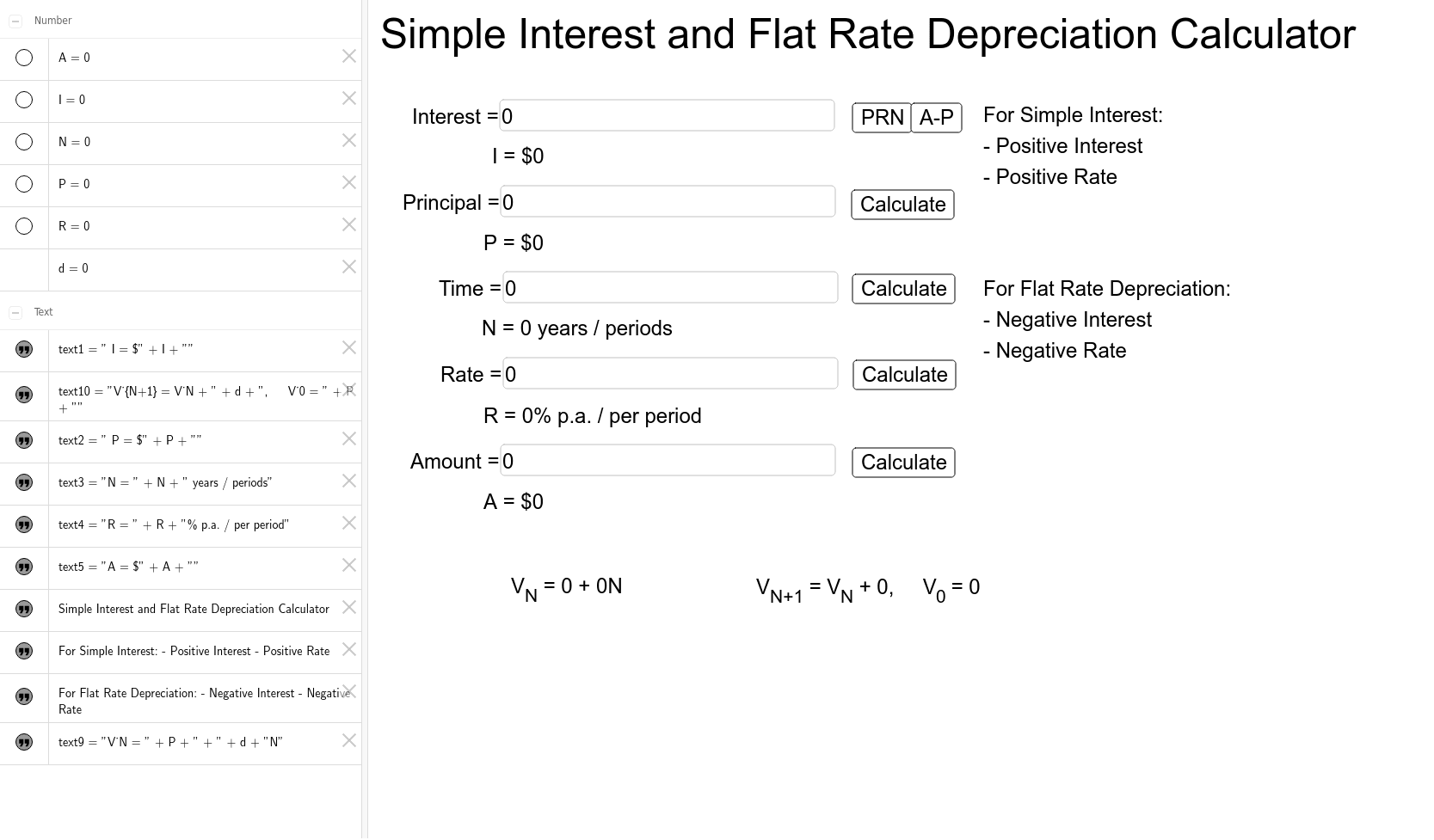

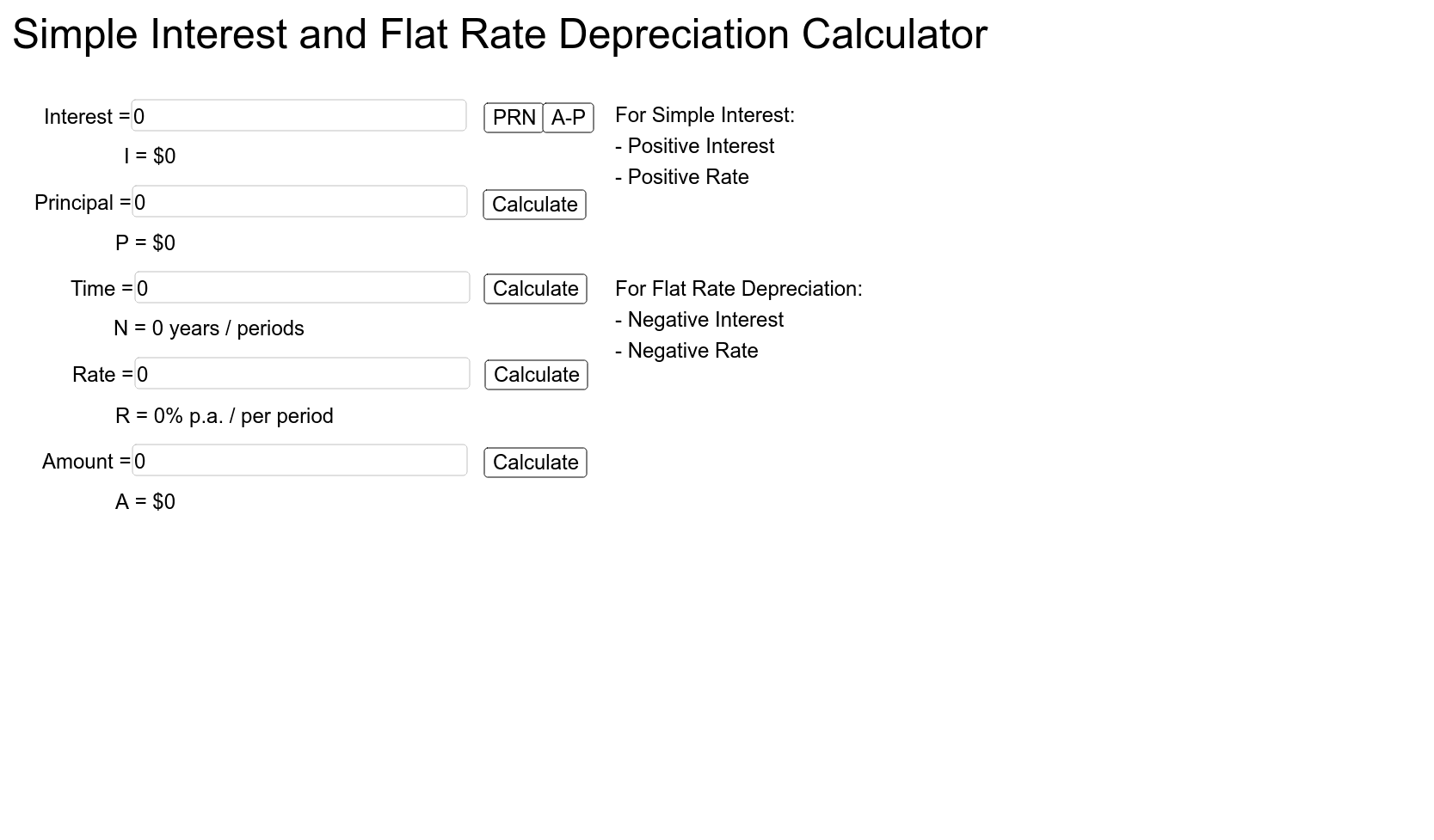

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Depreciation Depreciation Is Concerned With The Value Of An Item Of Equipment After It Has Been In Use For Some Time People In Business Need To Calculate Ppt Download

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Topic Flat Rate Depreciation Showme Online Learning

Depreciation Calculation

Rate Adjustments Flat Rate Depreciation Method Oracle Assets Help

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Depreciation Formula Calculate Depreciation Expense

2

Topic Flat Rate Depreciation Showme Online Learning

Solved Listed Below Are The Flat Rate Depreciation Equations Chegg Com

Depreciation Calculation For Flat Rate Methods Oracle Assets Help

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Simple Interest And Flat Rate Depreciation Calculator Geogebra